CONTAINER 20 FOOT AND 40 FOOT RO RO

GEE SHIPPING // Tel: 0203 086 8311

GEE SHIPPING // Mob: 0795 023 1110

We offer services for companies, groups and individuals

Full payment must be made 4 (four) weeks in advance prior to the loading date. You can either make a deposit earlier to secure the prices as prices quoted today cannot be guaranteed,

unless it is booked as prices are based on the exchange rate at the time of confirmed bookings.

When confirming your dates for the container, you should put in writing to us at Gee Shipping.

There will be a £100 non refundable booking fee deducted from the amount should you decide to cancel. Cancellations should be made at least one week prior to the order date and changing date should be made one week in advance.

Should you require any further correspondence in regards to this please do not hesitate to contact us on the above details.

When ordered to ship it will come on the back of a 44 ton trailer about 1220 m (4 ft) off the ground its always best to have us load & secure your cargo or have your own load team with enough hands on deck to complete the load within 2-3 hours depending on size of container or demur rage charges apply.

Containers are available to buy & ship

If you are going for automobile shipping company then the very first question which arise here is "What is the cost?" You will get the sure answer only after if the company is aware of the destination like where you want them to pick it up and drop it off. A proper consideration should be there if you have a specified date of delivery and want the automobile shipped.

All of these things will count for the automobile shipping costs. The delivering cost will be less. The destination of the automobile is the most important factor; the price for automobile shipping will totally depend upon it. If it is door to door then it will cost much.

The quotes from several companies should be collected if you want to have a right price. The companies will not charge at all for receiving the quotes. You need to be smarter to ask for the total cost to avoid having any hidden fees charged to the bill that you were not aware of.

Some companies may require a deposit, while others require full payment up front. None of the companies will allow you to pay the total bill when the automobile is delivered.

Customers Who Provides Their Own Containers:

Customers wishing to provide their own container should be reminded that ALL containers MUST be C.S.C PLATED, AND OF I.S.O STANDARD.

There will also be and inspection charge of £100, + ship PRICE

Shipment Only Price Does NOT Include Purchase Of Container.

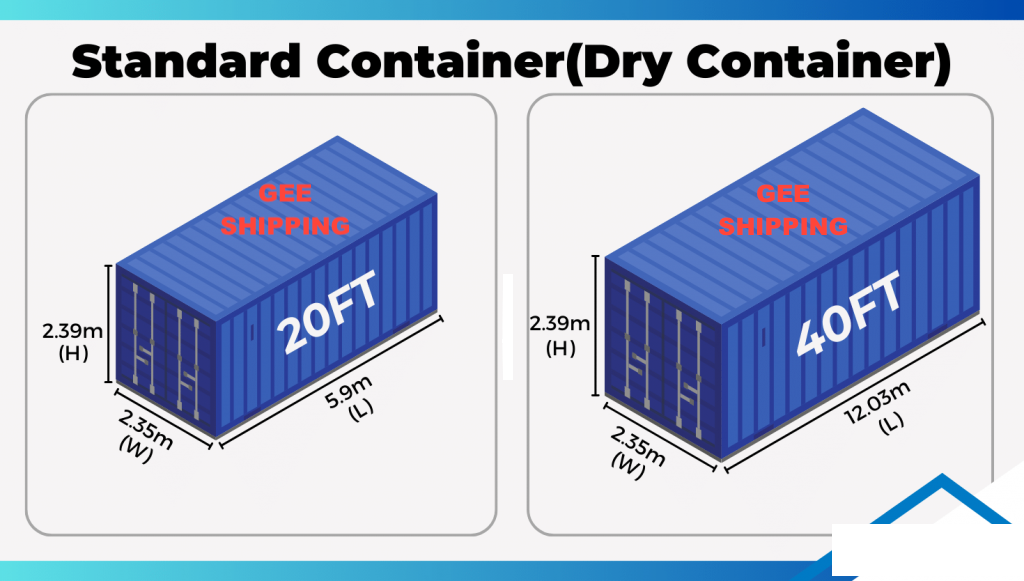

PURCHASE OF A 20 FT CONTAINER From £1899.99 (+) VAT AND (+) PLUS SHIPPING OF THE CONTAINER.

PURCHASE OF A 40 FT CONTAINER From £2799.99 (+) VAT AND (+) PLUS SHIPPING OF THE CONTAINER.

Methods of Container Shipping for Shipping Household / Shipping Personal Goods:

Container will arrive at your premises on a articulated vehicle - cannot be placed on the ground, goods must be loaded into container by gee shipping yourselves - labour is provided.

(Container will therefore be approx 5 ft from the ground, please arrange appropriate loading facilities)

If you require the container on the ground this is a additional charge.

Methods of Container Shipping for Shipping Household / Shipping Personal Goods:

1. Live Load - With live load container shipping service, we drop off the container at your door. You get (3) three hours free loading time, with any additional time needed to load at £85.00 an hour. The trucker will wait until you have finished loading and securing your goods in the container. When you are finished, the container will be returned to the shipping terminal.

2. Warehouse/Terminal Loading - If applicable, you deliver your goods or vehicle or both to the closest receiving warehouse/terminal to you. Once your goods are received, they will be loaded and secured in the container and delivered to the shipping terminal.

3. Drop Off - For drop off container shipping service, If applicable, we drop off the container at your door, you get 1 or 7 days (or a weekend) to load and secure your goods in the container, and when you are finished, we will pick up the full container and return it to the shipping terminal.

Shipping Household / Shipping Personal Goods

You pack all small items well in any good, clean boxes and wrap big items or furniture in moving blankets or plastic. If you have everything packed and ready to go when the container is delivered to your door, and if you and 3 to 5 friends help you load and secure your goods within the container, it shouldn't take you more than 2 or 4 hours at the most to finish loading and securing your goods in the container

You can buy rope and use the hooks inside the container to secure your goods from moving and shifting during the voyage. Or you can hire GEE SHIPPING to load and secure your goods in the container for you.

Hiring GEE SHIPPING to load and secure your goods in a 20' container will probably cost you around £449.99, and for a 40' container around £649.99 (*PLEASE NOTE* this is not the cost for shipping the container). Also, don't forget to make a packing list of what will be shipped in the container.

Shipping Household / Shipping Personal Goods with a Vehicle

You pack all small items well in any good, clean boxes and wrap big items or furniture in moving blankets or plastic. You will need a 40' container for shipping a vehicle, furniture, and boxes of household/personal goods. A 20' container is applicable when you want to ship a vehicle and some boxes of household/personal goods.

Depending on the size of your vehicle, whatever you can fit, including furniture, in the container is okay, but space will be limited in a 20' container. You can also pack belongings in the vehicle itself and the trunk of the vehicle.

There are 3 possible methods when shipping household / shipping personal goods with a vehicle

1. If applicable, a 20' or 40' container is delivered to your door, either live load container shipping or drop off shipping method, where you load and secure everything, including the vehicle, inside the container.

The container stands about 4' (feet) above the ground on a chassis. So, you will need to hire a flat bed towing truck to bring the vehicle on a level with the container, push the vehicle inside the container, block the tires of the vehicle, and lastly strap the vehicle down in the container so it will not move around. Of course, there can be no gas in the vehicle. The gas level has to be less than 1/8 a tank of gas and the battery must be disconnected. When you are finished, the container will be returned to the shipping terminal .

2. If applicable, a 40' container (20' container not applicable) is delivered to your door, either live load container shipping or drop off shipping method, where you load and secure your furniture and boxes of household/personal goods within the container, leaving room for your vehicle (bumper to bumper), plus a couple of extra feet. Once that is finished, the container will be picked up and brought to the closest receiving warehouse to you.

You will also deliver your vehicle to this receiving warehouse. We will then load and secure your vehicle into the container with your household/personal goods - previously loaded by you, and deliver the container to the shipping terminal. Also, the gas level has to be less than 1/8 a tank of gas.

We offer you the choice of container shipping, which will give you the security of having your vehicle travel inside a sealed, metal container if you prefer a more individualized way to ship your vehicle. Inside a locked container, your vehicle will stay which will only be opened once it has reached the destination country. You can opt to cover your car with full Marine Insurance to ensure total protection and peace of mind in shipping automobile.

CONTAINER 20ft & 40ft

We can arrange shipping of your car, van, bus or truck to the following popular destinations: Kenya, Tanzania, South Africa, Mozambique, Ghana, Cyprus, Malta, Senehal, Ivory, Coast, Benin, Liberia, Gambia,Guinea, Togo, Gabon, Cameroon, Angola, Congola, Congo DRC, Rrpublic of congo, Canada, Belgium, Netherlands, Germany, Slovenia, Turkey, Greece, Sweden, Denmark, Israel, Brazil, Argentina, Trinidad and Tobago and many more......

Roll on roll off shipping services

RORO vessels take on units such as cars, 4x4 vehicles, trucks, coaches, vans and trailers. Under deck shipment is the cheapest overseas shipping for cars, trucks, vans, trailers, lorries & coaches compared to container shipment. We ship vehicles to most left and right hand drive countries. Ports of Tilbury, Sheerness, Southampton, Felixstowe, Liverpool serve ocean-goingroll-on, roll-off (RORO) vehicle ferry services. International vessels are purpose-built car carriers, used by manufacturers to deliver brand new and used vehicles around the world. Cars are protected from the elements in enclosed car decks and are secured by straps and chocks. Service frequency is usually once or twice a month, and the transit time is sometimes longer than for container vessels, but there can be useful cost savings on some routes over container shipment. Ascope shippers offer RoRo ocean transportation to Antigua, Barbados, Dominica, Grenada, Jamaica kingston, Jamaica Montego Bay, Montserrat, St Lucia, St Kitts, St Vincent, Trinidad. Kenya, Tanzania, South Africa, Mozambique, Ghana, Tunisia, Cyprus, Malta, Egypt, Namibia, New Zealand, Hong Kong, Nigeria, Morocco, Tunisia, Libya, Mauritius, Canada, Spain, Italy, Trinidad and Tobago, Portugal, Belgium, China, Japan, Chile, Germany, Slovenia, Turkey, Greece, Israel, Sweden, Brazil, Uruguay, Argentina, Zimbabwe (Beitbridge,

*Please enquire for the rates if the country you want to ship to is not listed

SHIPPING

VEHICLES

Couple

of things to

think about before

you send a car overseas:

You’ll need to tell the Driver and Vehicle Licensing Agency (DVLA) when you are taking your vehicle out of the country on a permanent basis. If you are taking your vehicle or a hired vehicle on a temporary basis, you must take the appropriate documentation with you.

When a UK registered vehicle is taken out of the country for 12 months or more, it is regarded as being permanently exported from the UK. You can tell DVLA if you are taking your vehicle out of the UK permanently by filling in the purple section ‘Notification of Permanent Export’ (V5C/4) of the Vehicle Registration Certificate (V5C), this should be sent to DVLA, Swansea SA99 1BD. The rest of the V5C should then be kept, as you may need this to re-register the vehicle abroad, as once exported, your vehicle will become subject to the legal requirements of the new country.When shipping your car overseas from the UK, please remember that overseas customs formalities vary from country to country.

(Source: www.direct.gov.uk)

🇰🇳 Process and Documentation to Import a Motor Vehicle into Saint Kitts and NevisGuidelines to follow while importing used car in Saint Kitts and Nevis :-Shipping Ports :-Port for

shipment of used

vehicle is Basseterre in

Saint Kitts

and

Long Point in Nevis.Right-hand drive vehicles :-Importation of vehicles with the steering wheel on the right side is allowed.Documents required for port clearance :-* Bill Of Lading (BOL)* Bill of Sight* Import License* Commercial/ Purchase Invoice* Copy of Title Import duty and taxes :-Import Duty- 45%VAT- 17%Customs Service Charge-12%Vehicle Environmental Levy (VEL) is based on the aged of vehicle.* Less than 2 years – $1000 E.C.* 2 years or more but less than four years after the date of manufacture -$3500 E.C.* 4 years or more after the date of manufacture – $5000 E.C. Returning Nationals :-* Citizen of Saint Kitts and Nevis

should have lived abroad for a period of 10 years or more and has return to the nation permanently.* Concession given only on one vehicle imported within a family.* Importer should have owned the vehicle for at least a year before importation and should have a copy of the title from the country of origin.* Age of applicant should be 18 years and should posses a valid driving license in the country of origin.* Vehicle clearance within six months from Customs after arrival in the nation.* Importer should not transfer the vehicle ownership within four years of the grant of concession.* To be considered as a returning resident, returning national should during first three years of return, must not return abroad and reside there continuous period of more than 3 months.* Returning students who have been living in abroad for less than ten should provide some college/university documentation as a proof to the Customs Officer. Concession is given at the discretion of the Comptroller of Customs. Visit St. Kitts & Nevis Customs Department Official WebsiteEXPORT IMPORT NEVIS

🇬🇩 Process and Documentation to Import a Motor Vehicle into GrenadaGuidelines to follow while importing used car in Grenada :-Shipping Ports :-Ports for shipment of vehicle in Grenada are Saint George’s and Grenville. No specific inspection is required on used vehicles imported in Grenada.Right-hand drive vehicles :-Importation of vehicles with steering on right-hand side is allowed in Grenada.Documents required for port clearance :-Commercial/ Purchase Invoice determining vehicle type, make, weight.Bill Of Lading (BOL)Insurance certificateImport licenseValue Declaration FormCertificate of Title and RegistrationNote: In case of absence of Invoice, vehicles may be examined on a form C22.Taxes and Duties on used vehicles :- 1. Environmental LevyUsed Vehicles (1-4 years old) – 2%Used Vehicles (over 5 years old) – 30%Used Trucks :- * 1-10 tons: 5% * 10-20 tons: 10% * Over 20 tons: 20%1. Customer Service Charge :- CSC of 5% is imposed on used vehicles imported into the country.2. Common External Tariff (CET) – It ranges from 5%- 40% depending upon the cost of insurance and freight value of vehicles imported.3. Value Added Tax (VAT)-The VAT as proposed provides for a standard rate of fifteen percent (15%).Returning Residents :- Grenadian nationals who have been residing abroad a period of seven years continuously and have decided to return to Grenada on a permanent basis are considered as returning nationalists.Proof of Eligibility :-* Valid passport* Proof of nationality – (passport, birth certificate, etc.)* One-way ticket to Grenada* Retirement letter from the last place worked* Pension letterDuties and Taxes :-* Customs Service Charge- 5%* Environmental Levy- $2000, irrespective of ageThe importer shall abide by the following conditions after exemption on duty is granted :-* The importer shall not sell, lend, exchanged or otherwise disposed of the vehicle within a period of three years without the payment of the applicable duties.* The importer is allowed to sell the vehicle after three years without the payment of Customs duties (Residual Duties).* If the returnee leaves the country for a period less than six months then the Comptroller of Customs must be informed of the custody of the vehicle.* In case the returnee leaves Grenada for a continuous period of over six months, then all applicable duties will be immediately paid in full. Except for special circumstances as determined by the Comptroller of Customs.Note: If any term of the agreement is violated, then the Comptroller reserves the right to seize the vehicle as being liable to penalty pending payment of the applicable duties in full. Visit Grenada Customs Department Official WebsiteEXPORT GRENADA IMPORT VEHICLES

🇧🇸 Process and Documentation to Import a Motor Vehicle into BahamasGuidelines to follow while importing used car in Bahamas :-Shipping Ports :-The common port in Bahamas

for importation of used vehicles from Japan is Freeport and Nassau.Left-hand drive vehicles :-Importation of left hand drive vehicles is preferred in Bahamas.Age restriction and Inspection :-Age restriction on used vehicles imported in Bahamas is four years. Special permission is required for importation of trailers and caravans. Upon arrival the vehicle must be taken directly to the Road Traffic Department for inspection and licensing.Documents required :-* Copy of Certificate of Title and Registration* Original Commercial/ Purchase Invoice* Import permit* Bill of Lading Duties and taxes :-Used Vehicle Value Duty Stamp Tax$10,000 or less 45% 7%$10,000-$20,000 50% 7%$20,000 or more 65% 7% Visit Bahamas Customs Department Official WebsiteBAHAMAS EXPORT IMPORT VEHICLES

🇩🇴 Process and Documentation to Import a Motor Vehicle into Dominican RepublicGuidelines to follow while importing used car in Dominican Republic

:-Shipping Ports :-Port for shipment of used vehicle in Dominican Republic

is Rio Haina.Left-hand drive vehicles :-Importation of left-hand drive vehicles is allowed in the country.Documents required :-* Original certificate of Title and Registration* Commercial/Purchase Invoice – original & driver’s license, & license plate* Residence Visa* Dominican Consular invoice – original, stamped at nearest Dominican ConsulateCertain points to consider while importing in Dominican Republic :-* Only one vehicle is allowed for importation per person.* All vehicles being imported must be in the owner’s possession for a minimum of one year before importation.* Engine size on all imported vehicles is limited to six cylinders.* Importation of all luxury vehicles is prohibited.* Motorcycles are subject to taxes and duties.* It is important for the importer to be present in the Dominican Republic

for customs clearance of any vehicle.* As a new resident you can bring in a car at little or no duty if you have owned it for two years, and it is less than five years old. Visit Dominican Republic Consular Information WebsiteDOMINICAN REPUBLIC EXPORT IMPORT VEHICLES

🇵🇦 Process and Documentation to Import a Motor Vehicle into PanamaGuidelines to follow while importing used car in Panama :-Shipping Ports :-Major shipping ports in Panama are Balboa, Cristobal and Panama City.Left-hand drive vehicles :-Importation of left-hand drive vehicles is permitted in the country.Documents required :-* Bill Of Lading (BoL)* Transit Letter* Property Letter* Certificate of Title and Registration* Commercial /Purchase Invoice* Certificate of Environmental Control and Pollution CertificateTaxation in Panama :-There are no import restrictions on new or used cars and trucks into Panama. While importing a vehicle in Panama, duty tax is around 30%, which depends upon the value of the car. According to Panamanian customs laws, automobiles coming to Panama are subject to import tax except for those belonging to qualified diplomats, members of international organizations, persons with Retiree status, or U.S. contractor. Duty free importation of only one vehicle is allowed to diplomats, members of international organizations, persons with Retiree status, or U.S. contractor. For other auto, import duties have to be paid. Visit Panama’s Custom Department Official WebsiteEXPORT IMPORT PANAMA VEHICLE

🇬🇾 Process and Documentation to Import a Motor Vehicle into GuyanaGuidelines to follow while importing used vehicle from Japan :-Shipping Port :-The most recommended port for Guyana is Georgetown.Age Restriction :- Japanese used vehicle imported in Guyana should not be more than 5 years old. Small trucks up to 3 tons must be less than four years old.Right-Hand Drive Vehicles:-Only right hand drive cars are imported in Guyana.Inspection required :-No mandatory inspection is required on second-hand vehicle imported from Japan.Documents required :-* Original BOL (Bill Of Lading)* Identification Proof* Commercial/Purchase Invoice* Certificate of insurance* Non-sale certificate* Original registration and title* De-registration certificateImport Tax Rates :-Taxes are calculated generally on the basis of engine size and manufacturing year.1. For Private Vehicles :- * Custom Duties- 150% * VAT-16% * Excise Tax- 10-110%2. * Custom duty depends on cc starting from 4200-6200 USD.3. For Commercial Vehicle :- * Custom Duties- 150% * VAT-16% * Excise Tax- 10-110%4. * Custom duty depends on cc starting from 13500 USD.Engine Capacity Rates in USD0-1000 cc 42001000-1500 cc 43001500-1800 cc 63001800-2000 cc 65002000-3000 cc 135003000 and above 14500 Visit Guyana Consular Official Website

🇹🇹 Process and Documentation to Import a Motor Vehicle into Trinidad & TobagoGuidelines to follow while importing used into Trinidad :-Shipping Port :-Port for

shipment of vehicles to

Trinidad is Port of Spain.Age Restriction :- Cars should not be more than 4 years old. For vehicles to be used as taxis, they must not more than 3 years from the date of manufacture.Right-Hand Drive :-Right Hand Used cars can be imported only with a valid import license. Car should not be fitted with a diesel engine.Inspection :-No specific Roadworthiness inspection is required on import of used vehicles.Required Documents while importation :-* Four copies of Customs Declaration Form (C82 Form)* CARICOM Area Invoice (this is provided by the supplier and is necessary for any goods entering the CARICOM region).* Supplier’s Invoice* Bill of Lading (BOL)* Import License* Deregistration Certificate:- The certificate must have manufacturing date, engine number and chassis number that match the vehicles.* Original PassportImport Tax Rates :-1. up to 1599cc :- * 25% * 15%2. 1600cc to 2000cc * 35% * 15%3. 2001cc to 3000cc * 40% * 15%4. 3000cc and above * 45% * 15% Visit Trinidad and Tobago’s Official Government WebsiteEXPORT IMPORT SHIPPING VEHICLES TOBAGO TRINIDAD.

🇸🇷 Process and Documentation to Import a Motor Vehicle into SurinameGuidelines to follow while importing used vehicle to Suriname :-Shipping Port :-The most recommended port of importation is Paramaribo.Age Restriction :- • Used cars should not be more than 8 year old. • Used buses should not be more than 15 years from the date of manufacture. • No age restriction on importation of used trucks.Right-Hand Drive :-Right Hand Drive (RHD) vehicles are permitted to enter in Suriname.Inspection on Vehicles :-No specific inspection is required on import of used vehicles.Documents required for custom clearance :- • Bill Of Lading- It must reflect car’s maker and model, chassis & engine number, weight, cubic capacity, year of production. • Original Commercial/Purchase Invoice. • Certificate of Title and Registration – must be original. • Circulation Permit. • Drivers License & International Insurance Policy (green card). • A copy of passport or ID-card. • Insurance certificate for motor vehicle.Taxation :- • CIF value less than $25,000, then tax rate of 25% • CIF value greater than $25,000, then tax rate of 40%Annual taxes for the vehicle depend upon weight. Delivery of the vehicle from port to residence cost approximately 125.00USD. Visit Official Website for the Government of SurinameEXPORT IMPORT SURINAME VEHICLES

🇩🇲 Process and Documentation to Import a Motor Vehicle into DominicaGuidelines to follow while importing used car in Dominica :-Shipping Ports :-Major destination port in Dominica for used vehicle importation is Roseau.Right-hand side :-As the traffic moves on the left side of the road on Dominica; consequently, car steering wheels are located on the right hand side of the vehicle.Duty and Taxes on used vehicle imported :- 1. Import Duty- 40% of the customs value. 2. Customs Service Charge (CSC) – 3% of the customs value. 3. Environmental Surcharges- $3,000.00 per unit on motor vehicles manufactured five years or more, otherwise 1% of the customs value for vehicles manufactured less than five years. 4. Excise Tax- 28% of the customs value plus the import duty plus the customs service charge.*Exemption is given on vehicles purchased by Diplomats.1. Value Added Tax (VAT) – 15% on customs value plus import duty plus customs service charge plus the excise tax.2. Registration and proof of ownership. Documents required for Customs clearance :-* Original Certificate of title and registration* Original purchase or Commercial Invoice* Original Bill Of Lading (BOL)* Original driver’s license* Bill of Sale* Foreign Registration papers* Export documents* Insurance Policy* Police Certificate of Registration* Dominican consular invoice, stamped by the Dominican consulateReturning Residents :-A person shall be deemed to be a returning resident if they have returned for permanent residence, have attained the age of 18 years and is a citizen of Dominica by birth. The returning resident must prove prior ownership of the vehicle country of residence upon their importation into Dominica. Receipts and invoices for the vehicle should be made available upon request by the Customs Officer. The vehicle must be imported from the country where the applicant resided continuously for the past seven years immediately before returning to Dominica. Only one member of a family returning home will be eligible.Duties and Taxes :-Excise Tax- 28%Customs Service Charge-3%Environmental Surcharge :- * $3000 is applicable if the vehicle is 5 years or older * 1% if the vehicle is less than 5 years old. Returning Resident should abide by following condition :- * The Returning Resident will be required to enter into an agreement with the Comptroller of Customs. * It is not allowed to sell, trade, give away, or otherwise dispose of the vehicle within a period of five years without paying necessary duties. * It is allowed to sell the vehicle after five years without the payment of customs duties. However, approval of the Minister for Finance after consultation with the Comptroller of Customs is required. * If the returnee leaves the country for a period less than six months then the Comptroller of Customs must be informed of the custody of the vehicle. * In case the returnee leaves Dominica for a continuous period of over six months, then all applicable duties will be immediately paid in full. The exemption is given on special circumstances as determined by the Financial Secretary. Note- If any term of the agreement is violated then the Comptroller reserves the right to seize the said vehicle as being liable to fined pending payment of the applicable duties in full. The Comptroller also reserves the right to sell the vehicle by public auction after a period of two months from the date of seizure. Visit Dominica Customs Department Official Website

🇦🇬Process and Documentation to Import a Motor Vehicle into Antigua And BarbudaGuidelines to follow while importing used car to Antigua And Barbuda :-Shipping Ports :-Port for importation of used vehicles in Antigua and Barbuda is St. John’s port.Right-Hand Drive vehicles :-The country permits importation of right-hand drive vehicles.Age Restriction :-Importation of used and recondition vehicles older than five years in Antigua and Barbuda is prohibited.Required Documents :- • Import license from Ministry of Trade • Refrigerant form from the National Ozone Office within the Ministry of Trade • Commercial or Purchase Invoice • Bill Of Lading (BOL) • Environmental Levy Form • Certificate of Title and Registration • Insurance Policy & log book showing length of ownership Duties and Taxes :-The duties and taxes to be paid are determined by the applicable Tariff Code and the Customs Procedure Code (CPC). • VAT-15% of the total value of the vehicle. • Customs Duty- utmost 60% depending on the CIF of the vehicle. • Environmental Levy imposed- $6000. Returning Nationals :-Nationals returning to Antigua and Barbuda

who have been living abroad for ten years or more will be regarded as “returning nationals”, and are eligible for duty free importation of one vehicle, provided that the vehicle has been owned for at least two years. Consideration will be given to the special circumstances of the returning individuals and their probable contribution towards the nation building.Returning nationals are also exempted from Antigua and Barbuda Sales Tax (ABST) charges on a vehicle which has been owned by them for at least a year prior to its importation and is used for personal purposes. Visit Antigua & Barbuda Customs Department Official WebsiteANTIGUA BARBUDA EXPORT IMPORT VEHICLES

couple of things to think about before you send a car overseas:

EXPORT

IMPORT

VEHICLES

TO JAMAICA

TEMS REQUIRING IMPORT LICENCES UNDER THE 2014 MOTOR VEHICLE IMPORT POLICY (MVIP) ADMINISTERED BY THE TBL.

HS CODE DESCRIPTION OF GOODS 84.27 Cranes and forklift trucks, other work trucks fitted with lifting or handling equipment 84.29 Self-Propelled Bulldozers, angel dozers, graders, levellers, scrapers, mechanical shovels, excavators, shovel loaders, trenchers, back hoes, harvesters, pipe layers, road rollers, asphalt plants and pavers (exclude tamping machines – no licence required) 84.30 •Compactors, Concrete Drop Hammers (exclude pile drivers and pile extractors – no licence required) •No other good that falls within this heading requires a licence

84.33 •Mowers for lawns, park or sports ground with 12.5 Horse Power/ 344cc and above •Mowers for lawns, park or sports ground with below 12.5 Horse Power/ 344cc do not require a licence •No other good that falls within this heading requires a licence

Sugarcane harvester 87.01 Tractors (other than tractors of heading 87.09). 87.02 •Light commercial vehicles (age not exceeding six (6) years) trucks with seating capacity 9-14 •Trucks designed specifically for the transportation of passengers: oSeating capacity 15 - 29 (age not exceeding twelve (12) years) oSeating capacity 30 - 44 (age not exceeding fourteen (14) years) oSeating capacity 45 & Over (age not exceeding twenty (20) years) 87.03 Motor cars (age not exceeding five (5) years) including: •All-terrain vehicles (ATVs)

Motor vehicles designed specifically for the transportation of passengers (age not exceeding ten (10) years) including:

•Ambulances •Hearses •Limousines.87.03

Motor vehicles designed specifically for the transportation of passengers (age not exceeding ten (10) years) including:

•Town cars

Classic/Antique/Limited Edition Vehicles- age limit is based on conditions stipulated at p 32 of the 2014 MVIP87.04

•Light commercial vehicles (age not exceeding six (6) years):

oPick-ups

oPanel/window vans

oTrucks with unladen weight less than 3000kg or 3 tonnes designed specifically for the transport of cargo •Trucks designed specifically for the transportation of cargo (Unladen weigh 3000KG/3 Tonnes and above):

o3,000 – 4,000kg (age not exceeding fifteen (15) years)

o4,001- 8,000 kg (age not exceeding twenty (20) years)

oOver 8,000kg (age not exceeding twenty five (25)years)

87.05 Mobile Kitchens ( age not exceeding thirty (30) years)

87.05 Street Sweepers ( age not exceeding thirty (30) years)

87.05 Special purpose motor vehicles/ equipment other than those specifically designed for the transport of persons or goods examples (breakdown lorries, crane lorries, fire fighting vehicles, concrete mixer lorries, spraying lorries, mobile workshops) mobile radiology units and all other motor vehicle equipment of similar make and usage. ( age not exceeding thirty (30) years)

87.05.20 Mobile Drilling Derricks ( age not exceeding thirty (30) years)

87.07

•Pick up cab

•Pick up beds

87.07 •Truck cabs

•Motor vehicle bodies

87.08.999 Motor vehicle parts (front and back clip)

87.09 Work trucks, self-propelled, not fitted with lifting or handling equipment, of the type used in factories, warehouses, dock areas or airports for short distance transport of goods; tractors of the type used on railway station platforms ( age not exceeding thirty (30) years) (parts of the foregoing vehicle – do not require a licence)

87.11 Motor cycles ( age not exceeding five (5) years)

87.11.9090 •Two-wheeled, self–balancing, battery powered electric vehicles (such as Segway PTs) •Hover boards

87.16.10 Trailers and semi-trailers of the caravan type, for housing and camping ( age not exceeding thirty (30) years)

87.16.20 Self-loading or self-unloading trailers and semi-trailers for agricultural purposes; other trailers and semi- trailers for the transport of goods( age not exceeding thirty (30) years)

87.16.31 Tanker trailers and tanker semi-trailers ( age not exceeding thirty (30) years)

Shipping Port :-

The most recommended port for shipments arriving to Jamaica to Kingston.

Age limit on importation of motor vehicles :-

According to new age limit for the importation of used vehicles

Cars imported should not be more than 5 years old.

Pickups should not be more than 6 years.

Trucks, Trailers and other heavy duty equipments can be 10 years old.

Special purpose vehicles such as Ambulance, Fire Brigade, and Town cars, vehicles modified for physically challenged people should not be more than 10 years of age.

Right-Hand Drive vehicles :-

Import of right-hand drive vehicle is allowed in Jamaica.

Documents required for importing vehicle :-

Import license issued by the Trade Board Limited, which authorizes the importation of the motor vehicle.

Title: The document issued by the Government of the country where the vehicle was purchased, to the owner of the vehicle.

Two identification proof such as Passport, Driver’s license, Nation Identification.

Bill of Lading :- It should contain necessary information about the vehicle, date of landing and the port of entry.

Invoice :- An invoice from the supplier is necessary for all vehicles importation.

Bill of Sight :- It contains details regarding the imported motor vehicle. It is a Customs certified document, prepared and signed by the dealer.

Tax Compliance :- It will be issued by Tax Administration Certificate Services Department.

Odometer inspection statement.

Import Entry (C87):- This import document should be presented to Customs by the broker and should contain all the details involving the vehicle, importer name, shipping information and the responsibilities.

Taxpayer Registration Number (TRN) :- A nine digit unique identification number obtained from Revenue Board.

Tax Compliance Certificate (TCC) :- A document obtained from Revenue Board as a proof that certifies that payments Certificate of tax liabilities and wage-related statutory deductions are up-to-date.

Import Duties and Taxes :-

Import duty 10-40%, vary depending upon the commodity being imported.

General Consumption Tax (GCT) :- It is applicable on all items except for Zero-rated and Exempted items. Current Rates: 17.5% on used vehicles.

Special Consumption Tax (SCT) :- It is applicable to only some petroleum products. SCT rates vary depending on the item.

Common External Tariff (CET) :- The rate of CET varies depending on the vehicle being imported. Current CET: 20% on Cars and Pick-ups whereas for Trucks, Vans and Buses CET is 10%.

Environmental Levy (ENVL) :- This will be applicable on all items that will have an impact on the environment. The rate for ENVL is 0.5% and is calculated on CIF value.

To drive the vehicle on the road :-

For registering the vehicle, Certificate of Fitness with the Import Entry documentation is required. The documents should be taken to the Revenue Service Center/ Tax Collectorate to register the vehicle and other purpose.

Other relevant Information :-

Every three years, Jamaica’s residents or returning Individuals can import up to two motor vehicles; one motorcar and one light commercial vehicle or any two light commercial vehicles.

Proof of immigration status such as a Work Permit must be shown by Non-Jamaicans.

Returning residents may import an older car, if they have owned the vehicle for at least 6 months and approved by the Trade Board.

A warranty of 90 days is required if buyer want to sell the used vehicle.

Do you intend to import a motor vehicle or motor cycle? If yes, you must first apply to the Trade Board for an Import Licence and receive same before making arrangements for the shipping of the vehicle to Jamaica .

Documents Required To Import a Motor Vehicle or Motorcycle

Import licence: Issued by the Trade Board Linited authorizing the importation of the motor vehicle or motorcycle.

Title : A document issued to the owner of the vehicle/cycle by the Government of the country where the vehicle was purchased.

Bill of Lading/Order: Obtained from the shipping agent with information about the particulars of the vehicle or cycle, the date it landed in the island and the port of entry.

Invoice : An invoice from the supplier is required for all motor vehicles or motor cycles.

Bill of Sight: This is a document on which details of the motor vehicle or motor cycles to be imported are recorded. It is prepared and signed by the broker and certified by Customs.

Tax Compliance (TCC): Obtained from Tax Administration Jamaica

Simplified Administrative Document (eSad) This is the electronic document on which all the particulars of the motor vehicle/cycle, the name of thE importer, shipping information and the Customs duties are recorded. It is completed by the Customs Broker and submitted to Customs. Only a licensed Customs Broker should complete this form ..

The importation of the following also require a permit from the Trade Board Ltd.

Motorcycles

Pick-up & Truck Cabs

Pick-up Beds

What is the method used for determining the value of motor vehicles?

Under the WTO Agreement, invoices are to be presented to Customs from which the value for duty will be derived.

Is there an age limit for the importation of motor vehicles? Yes.

For Light Commercial Vehicles (Pick-ups, Panel/Window Vans, Trucks with seating capacity of 9-14, and unladen weight less than 3000 kg or 3 tones) – six (6) years

For motor cars – Five(5) years

For motorcycles – Five(5) years

For Buses used for the transportation of passengers

seating capacity 15-29 – twelve (12) years

seating capacity 30-44 – fourteen (14) years

seating capacity 45 & over – twenty (20) years

For Trucks used for the transportation of cargo

3,000 – 4000 kg – fifteen (15) years

4001 – 8000 kg -fourteen (14) years

over 8000 kg – twenty five (25) years

For other heavy duty commercial equipment – thirty (30) years

Please contact the Trade Board at 967-0507 or 967-0674 for further information on age limits and import licence for motor vehicle.

Importation of Damaged Vehicles

The importation of motor vehicles that are considered to be in a damaged or salvaged state is PROHIBITED.

Individuals and Returning Residents

An individual or Returning Resident is allowed to import:

one (1) motor car and one (1) light commercial vehicle or

two (2) light commercial vehicles;

or one (1) light commercial vehicle and a regular commercial vehicle

Individuals residing in Jamaica are allowed to access this facility once every three (3) years. Returning Residents, having accessed the facility within a particular current year would not be eligible to import vehicles in the capacity of an individual until three (3) years after the date of the importation as a Returning Resident..

Applicable to Returning Residents Only:

All categories of motor vehicles: pick-ups, motor cars, trucks, trailers and other heavy duty equipment– Ten (10) years.

Who qualifies for concessions on motor vehicle importation?

Concessionary rates of duty on vehicles are usually given in special circumstances, for example, when the importer holds a job or position which entitles him to a concessionary rate of duty on the importation of a motor vehicle. People who qualify include farmers, senior teachers and government traveling officers.

Who grants these concessions?

The Ministry of Finance. Applications are submitted through the various government departments to the Ministry and the concession is granted after it is determined that the individual qualifies for such a concession.

Age limit for buses to be used in the transportation sector will be determined by the Ministry of Finance.

NOTE:Import Duty,Special Consumption tax and GCT is compounded, The processing fee and environmental levy is included in the aggregate Duty.

REVISED INDIVIDUAL RATE SHEET – May 2014

REVISED DEALER RATE SHEET – May 2014

CONTAINER 20ft & 40ft

We can arrange shipping of your car, van, bus or truck to the following popular destinations: Kenya, Tanzania, South Africa, Mozambique, Ghana, Cyprus, Malta, Senehal, Ivory, Coast, Benin, Liberia, Gambia,Guinea, Togo, Gabon, Cameroon, Angola, Congola, Congo DRC, Rrpublic of congo, Canada, Belgium, Netherlands, Germany, Slovenia, Turkey, Greece, Sweden, Denmark, Israel, Brazil, Argentina, Trinidad and Tobago and many more......

Roll on roll off shipping services

RORO vessels take on units such as cars, 4x4 vehicles, trucks, coaches, vans and trailers. Under deck shipment is the cheapest overseas shipping for cars, trucks, vans, trailers, lorries & coaches compared to container shipment. We ship vehicles to most left and right hand drive countries. Ports of Tilbury, Sheerness, Southampton, Felixstowe, Liverpool serve ocean-goingroll-on, roll-off (RORO) vehicle ferry services. International vessels are purpose-built car carriers, used by manufacturers to deliver brand new and used vehicles around the world. Cars are protected from the elements in enclosed car decks and are secured by straps and chocks. Service frequency is usually once or twice a month, and the transit time is sometimes longer than for container vessels, but there can be useful cost savings on some routes over container shipment. Ascope shippers offer RoRo ocean transportation to Antigua, Barbados, Dominica, Grenada, Jamaica kingston, Jamaica Montego Bay, Montserrat, St Lucia, St Kitts, St Vincent, Trinidad. Kenya, Tanzania, South Africa, Mozambique, Ghana, Tunisia, Cyprus, Malta, Egypt, Namibia, New Zealand, Hong Kong, Nigeria, Morocco, Tunisia, Libya, Mauritius, Canada, Spain, Italy, Trinidad and Tobago, Portugal, Belgium, China, Japan, Chile, Germany, Slovenia, Turkey, Greece, Israel, Sweden, Brazil, Uruguay, Argentina, Zimbabwe (Beitbridge,

*Please enquire for the rates if the country you want to ship to is not listed

When a UK registered vehicle is taken out of the country for 12 months or more, it is regarded as being permanently exported from the UK. You can tell DVLA if you are taking your vehicle out of the UK permanently by filling in the purple section ‘Notification of Permanent Export’ (V5C/4) of the Vehicle Registration Certificate (V5C), this should be sent to DVLA, Swansea SA99 1BD. The rest of the V5C should then be kept, as you may need this to re-register the vehicle abroad, as once exported, your vehicle will become subject to the legal requirements of the new country.

(Source: www.direct.gov.uk)